Intuit

During Summer 2022, I joined Intuit as a Product Design Intern on the TurboTax Flagship team. Over the course of 9 weeks, I worked primarily on the How to Spend Your Tax Refund project, which aimed to help 18.2M low-income TurboTax users decide the best way to user their tax refund towards meeting their financial goals. I designed the MVP experience, with the dry test planned for release in Q3.

MY ROLE

Product Design Intern

THE TEAM

Kelly Kosnik (PM Intern)

TIMELINE

June - September 2022

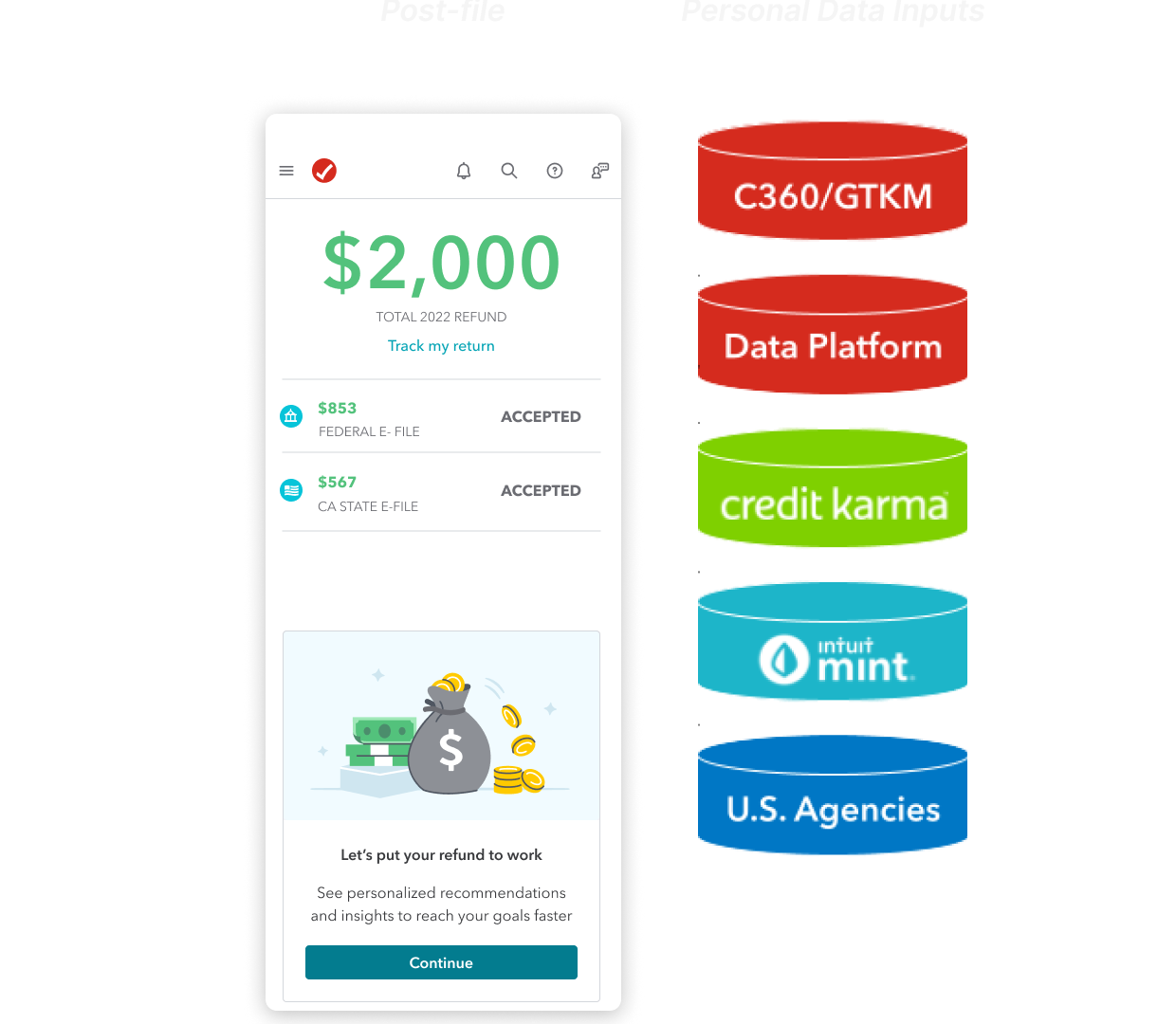

The Solution

Your personalized financial journey

Your personalized financial journey highlights what stage you should be focusing on and should be putting your refund towards to level up financially the fastest. Explore additional action items to level up for categories you’ve already mastered and areas you can prepare for in the future.

Immediately put your refund to work through the recommended options, with direct linkages to your account and the ability to split refunds among multiple financial goals.

Put your refund towards your goals instantly

Browse actionable resources

Browse additional personalized resources that can help you manage your finances across all categories — whether that’s securing a lower rate on student loans or unlocking more savings with a high interest account.

Helping low-income users decide how to spend their refund

I am a low income TTO customer receiving a tax refund bigger than any paycheck I’ve received this year

I’m trying to decide the best way to spend my refund to meet my financial goals

But I don’t know how I should prioritize paying off my various living expenses, debt, and other purchases to meet these goals

Because I rarely have the opportunity to plan financially beyond my day-to-day expenses and don’t know all the financial implications of these decisions

Which makes me feel confused, frustrated, and not confident that I’m making the right decision.

Customer Problem: Where do I put my refund?

Discover & Define

Goals

Working with a UXR, I conducted follow me homes with 6 low income customers to understand what goes through their mind when they get a refund, how they decide how to use it, and what’s their attitude on refund advice. I found that customers are looking for advice that is:

Personalized and timely

Financial advice that is customized to their situation and delivered just in time

Social proofed

Guidance from family, friends and other trusted individuals

Actionable and simple

Information that is actionable, simple and clear i.e rules of thumb

My PM and I then narrowed on the following goals that we wanted our solution to achieve

Emotional: Give customers confidence that TurboTax cares about their financial wellbeing year-round

Functional: Save customers money by helping them find the best way to use their refund

Business: Successfully promote sign-ups to other parts of the Intuit ecosystem such as Credit Karma & Mint

Understanding low-income customers

Explore the Solutions

Brainstorming and narrowing

Prototyping the quiz

+’s

-’s

Liked the concept of a fast, light-hearted quiz

Most expressed interest in additional tips

Trusted the reputation of TT for advice

Didn’t find the experience that valuable because:

Not much new information

Too black & white, wanted to see more options

Felt generic and impersonal

I organized a brainstorm session across multiple XFN team members, where we pulled out overarching themes

We then narrowed our ideas based on impact and feasibility, and found the “buzzfeed quiz” most promising and versatile

My quiz prototype aimed to test the assumption — Do people want financial advice while filing taxes? We conducted unmoderated testing with 6 customers and got valuable feedback

Iterate

I organized another brainstorming session to generate ideas around how might we make the recommendation more valuable, personalized, and actionable. I also met with data science and eng to understand better what data we could harness for this experience.

With our new directions, I developed three divergent recommendation screens and conducted a comparison test with users

Major decisions

Moving experience to Post-file, where there is more room for a meatier recommendation (more value)

Integrating personal touches through ecosystem data

(more personalized)

Explain and break down options other than the main recommendation (less black and white)

Link to actionable resources (new info)

Concept A

The info under the carousel was not very accessible. Overall ended up being more overwhelming than motivating.

Concept B

Data visualization was a huge emotional motivator. Easy to digest and simple. But some found the data viz confusing, and others failed to notice the tabs.

Concept C

Most clear and straightforward. Users really like receiving a personalized “financial journey” with step by step. However, it was found rather clunky.

With Concept B and C being the most popular, I refined my designs to combine the clarity of C with the motivation of B. I also collaborated with a content designer to fine-tune the wording

Going broad again on a recommendation

Testing three divergent recommendation concepts

Refining for motivation and clarity

Final Designs

Evaluate

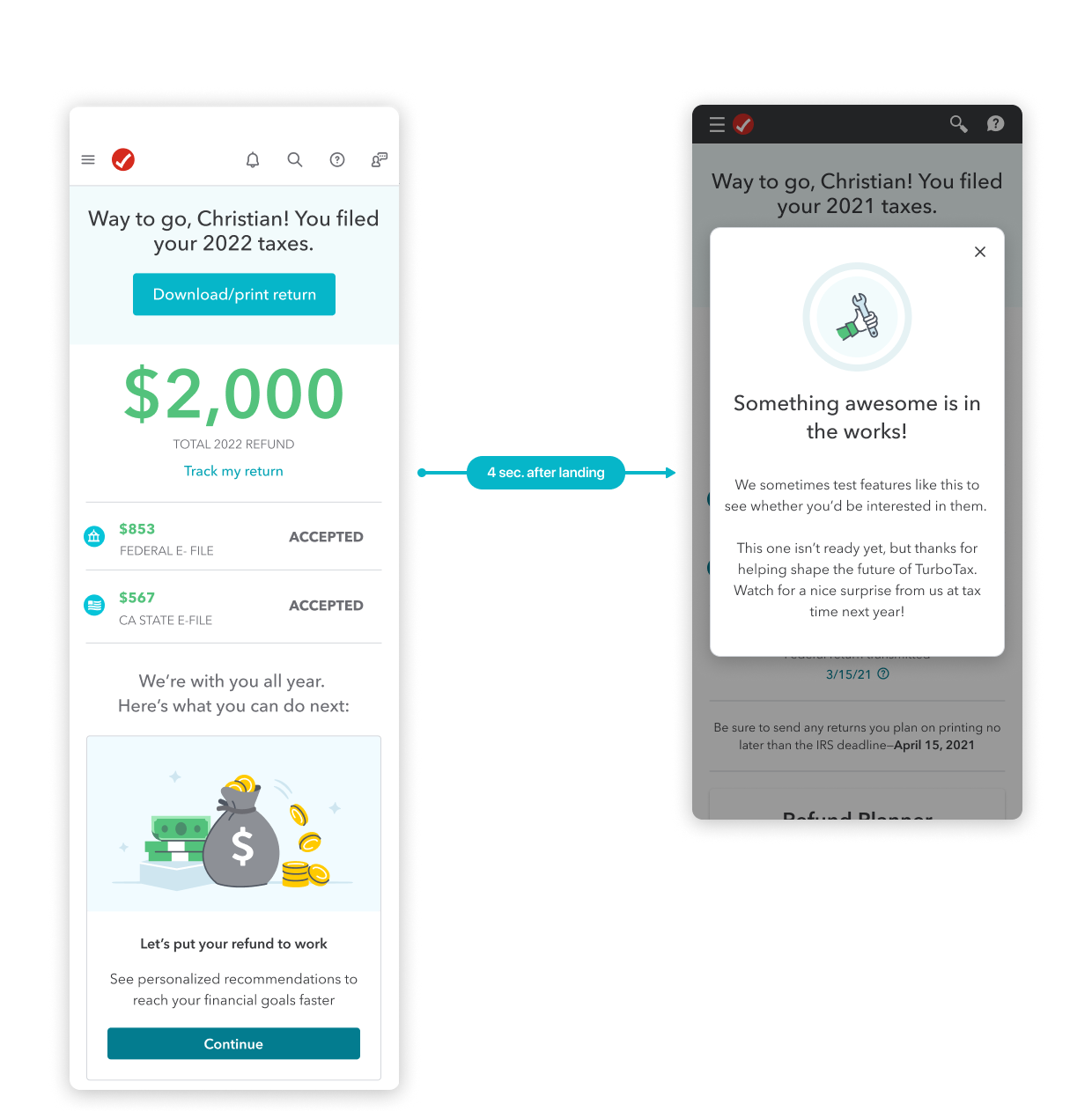

I worked with a PM to set this up to be launched Q3 in Post-file

Measure # of clicks on tile to test engagement and interest for this experience

To continue investing resources in this project if above a certain threshold

Dry test

Learnings

1. Prototyping without permission

This is a value that is practiced highly within Intuit. Through adopting it, I learned to be proactive about prototyping in order to ideas or kickstart conversations

2. Collaborating cross-functionally

Working with different disciplines including PM, content design, user research, data science, and engineering helped me practice how to communicate better and align on goals

3. Solving for business AND delight

As my first design internship at a large company, I learned not just the design process and skills, but also product strategy and how design fits into larger business goals